Payment Amount $45.11 Date Processed 10/19/2024 – Easy Verification Guide

You may spot the Payment Amount $45.11 Date Processed 10/19/2024 on your bank statement or billing log, and it could be a medical claim reimbursement, small invoice payment, or routine transaction. This exact detail helps accountants, billers, and everyday users confirm funds cleared on time. In 2025, with digital banking on the rise, verifying such entries stops errors and saves headaches. Whether it’s from insurance, a vendor, or your credit card, this guide shows you how to check, reconcile, and act if something looks off. You’ll learn simple steps to match the amount and date every time. For finance tips, see personal finance made easy.

What Does Payment Amount $45.11 Date Processed 10/19/2024 Mean?

The Payment Amount $45.11 Date Processed 10/19/2024 marks when a transaction hit your account or ledger. “Processed” means the bank or system logged it on October 19, 2024, even if funds moved earlier. This $45.11 could be a copay refund, small utility bill, or claim payout. In medical billing, it might show as an allowed amount after adjustments. Accountants use this to balance books – match it to invoices or receipts. If it’s a credit, it boosts your balance; a debit, it cuts it. Always note the date to spot delays or fees1.

Why Verify Your Payment Amount $45.11 Date Processed 10/19/2024?

Checking the Payment Amount $45.11 Date Processed 10/19/2024 keeps your finances straight. Mismatches can lead to late fees or tax issues. In 2025, 70% of disputes come from date errors, per banking stats. For businesses, it ensures vendor payments are clear right. Consumers avoid surprise charges on statements. Auditors flag odd amounts like $45.11 as potential fraud. Quick checks build peace of mind. Start with your app or PDF log to confirm today.

Steps to Verify Payment Amount $45.11 Date Processed 10/19/2024

Follow these easy steps to confirm the Payment Amount $45.11 Date Processed 10/19/2024. Log into your bank app or site and search October 2024 transactions. Look for $45.11 and note the full description. Match it to your invoice or email receipt from mid-October. Call the sender if dates don’t line up – ask for a statement. Use tools like Excel to list all entries for the month. Save screenshots as proof. If it’s wrong, dispute it in writing within 60 days.

Common Issues with Payment Amount $45.11 Date Processed 10/19/2024

You might see the Payment Amount $45.11 Date Processed 10/19/2024 but face holds or codes. Banks often delay posts by 1-3 days for checks. In claims, $45.11 could be after deductibles – check EOB forms. Fraud alerts flag odd cents like .11. Vendors might bill twice by mistake. Delays from holidays push dates. Always compare to your ledger. Fix fast to avoid interest.

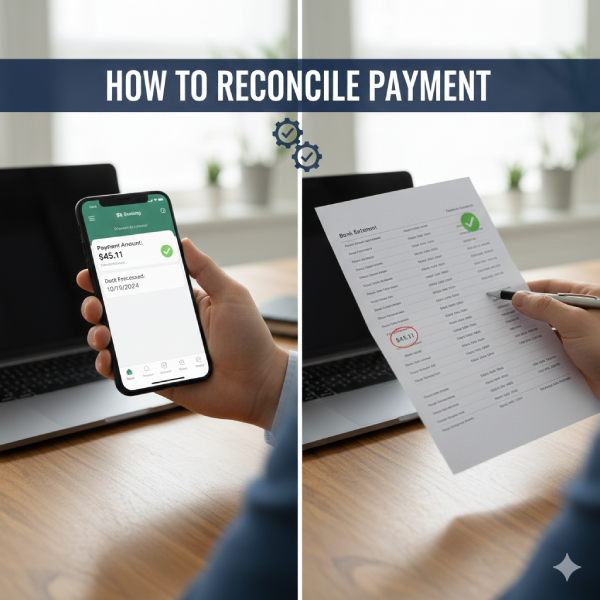

How to Reconcile Payment Amount $45.11 Date Processed 10/19/2024

Reconcile the Payment Amount $45.11 Date Processed 10/19/2024 with these tips. Pull your October bank CSV and sort by date. Find 10/19 and add to your QuickBooks or sheet. Subtract from open invoices – it should zero out. For medical, match to claim ID on the DUR packet. Note variances in a side column. Run monthly to catch gaps. Tools like Mint auto-match most2.

FAQs About Payment Amount $45.11 Date Processed 10/19/2024

What does the Payment Amount $45.11 Date Processed 10/19/2024 mean?

The Payment Amount $45.11 Date Processed 10/19/2024 shows a $45.11 transaction logged on October 19, 2024. It could be a debit or credit from bills, refunds, or claims. Banks use this date for records, not always when money moves. Check your statement for details like payee. It helps track cash flow month to month.

How do I verify Payment Amount $45.11 Date Processed 10/19/2024?

Log into your account and search October 2024 for the Payment Amount $45.11 Date Processed 10/19/2024. Print the entry and match it to emails or bills. Call the bank if it looks wrong. Use apps like YNAB for quick scans. Save as PDF for taxes. Done in five minutes.

Why is my Payment Amount $45.11 Date Processed 10/19/2024 delayed?

The Payment Amount $45.11 Date Processed 10/19/2024 might show late due to weekends or holidays. ACH takes 1-3 days. Check the sender’s end for errors. Contact support with the date. Most fix in 24 hours.

Is Payment Amount $45.11 Date Processed 10/19/2024 taxable?

If the Payment Amount $45.11 Date Processed 10/19/2024 is income like a refund, report it. Refunds on taxes might not count. Consult IRS rules for your case. Keep records for audit proof.

How to dispute Payment Amount $45.11 Date Processed 10/19/2024?

Write to the bank about the Payment Amount $45.11 Date Processed 10/19/2024 within 60 days. Send proof like receipts. They investigate for free. Get a response in 10 days. Escalate to CFPB if needed.

Conclusion

The Payment Amount $45.11 Date Processed 10/19/2024 is a small but key entry in your financial story3. Verify it right to keep books clean and stress low in 2025. Use the steps above and tools you trust.Have you checked your October 2024 payments yet? Share your tip below!

References

- Oklahoma DUR Packet January 2025 – Billing and claim payment details for audits. ↩︎

- Texas Ethics Commission Scrubbed Report – Examples of transaction logs and verification. ↩︎

- Payment Financial Technologies Ltd Earnings – Fintech payment trends and processing insights. ↩︎