MVIS Global Video Gaming & Esports Index: A Complete Guide

Let’s be honest gaming is no longer just a fun hobby where friends gather to play on a console after school. Today video gaming and esports have become global industries worth billions of dollars. Esports events sell out arenas, gamers stream to millions online and investors see opportunities everywhere. But with such a massive and fast-moving industry, people often ask: How do we track its growth?

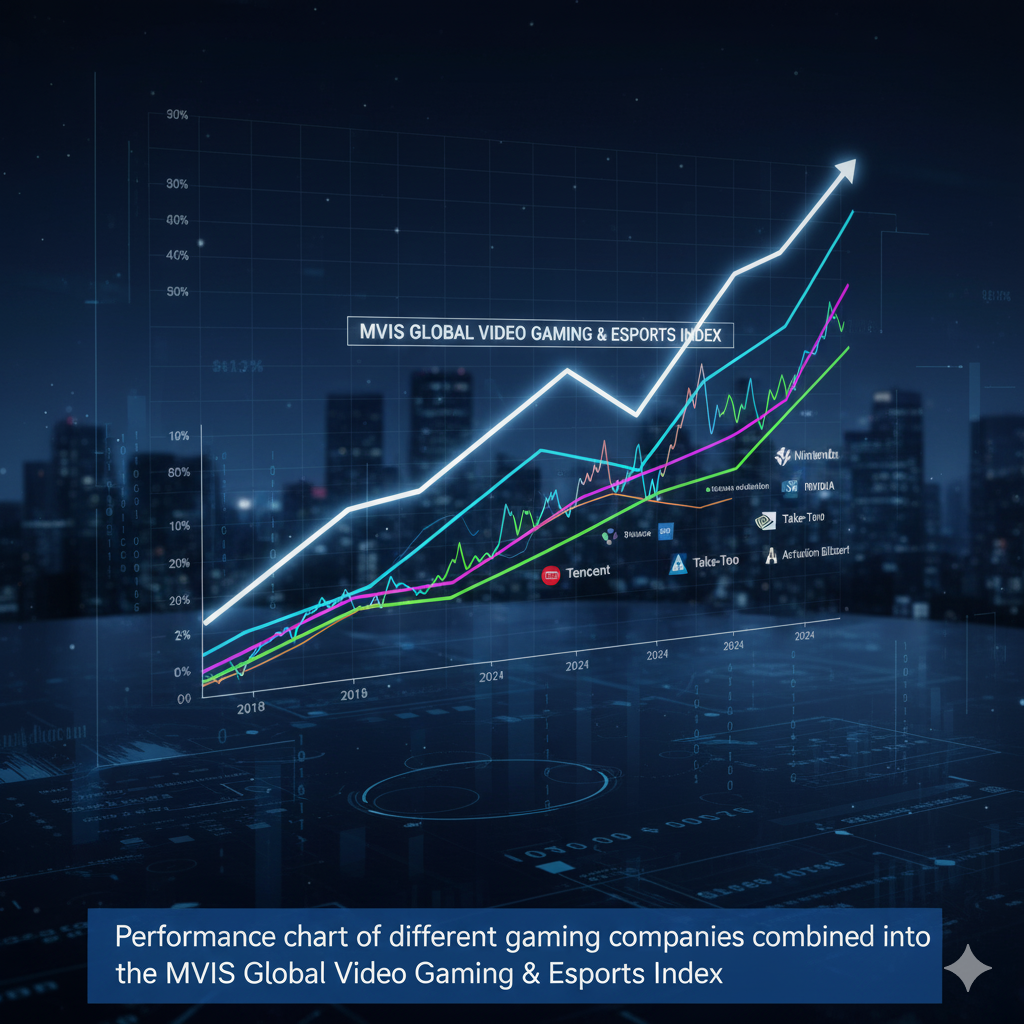

That’s exactly where the MVIS Global Video Gaming & Esports Index comes in. Think of it like a scoreboard but instead of showing which esports team is winning, it tracks the financial performance of gaming and esports companies worldwide. It’s not only useful for investors but also gives a clear picture of how powerful and influential this industry has become.

What Is the MVIS Global Video Gaming & Esports Index?

To put it simply, the MVIS Global Video Gaming & Esports Index is a stock market index created by MV Index Solutions (MVIS). Instead of focusing on just one company like Sony or Activision Blizzard, this index brings together many companies that earn most of their money from video games or esports.

This means the index includes:

- Console and PC makers

- Game developers and publishers

- Esports platforms and streaming companies

- Hardware producers like GPU or accessory makers

It then measures how all these companies perform in the stock market as a group. So, if you want to know how healthy the gaming industry is globally you just look at this index.

Why Does This Index Matter?

Now, you may wonder: why not just track one or two big companies? Well, the problem is, no single company represents the whole gaming world. For example, one company might be strong in PC gaming but weak in mobile gaming. Another may dominate esports but not console titles.

This index helps solve that problem because it provides a bigger picture.

Diversification – Instead of putting all money in one stock, investors spread risk across multiple gaming companies.

Trends – If mobile gaming rises or esports tournaments explode in popularity the index will reflect it.

Transparency – Investors see exactly which companies are included and how they perform.

Global Reach – It covers companies from the U.S Asia and Europe, showing the worldwide gaming scene.

A Quick Look at Gaming’s Growth

It’s worth pausing to see why this index even exists. Gaming is not just growing; it’s booming. According to [Newzoo](https://newzoo.com/), the global games market is expected to surpass $200 billion soon. Esports revenue alone is climbing past the $1 billion mark yearly.

Key Components of the Index

The companies included in the MVIS Index aren’t chosen randomly. They must meet certain conditions:

1. Primary Revenue from Gaming

At least 50% of their revenue should come from gaming or esports.

2. Market Size

They need to meet minimum market capitalization requirements.

3. Liquidity

Their stocks must be actively traded, making it easy for investors to buy or sell shares.

Some well-known names often included in this index are:

- Nintendo (famous for Switch and franchises like Mario and Zelda)

- Tencent Holdings (Chinese giant behind games like Honor of Kings and Riot Games’ League of Legends)

- Activision Blizzard (Call of Duty, Overwatch, World of Warcraft)

- Nvidia (makes GPUs used for gaming PCs and cloud gaming)

How the Index Is Calculated

You might be thinking: Okay, but how do they calculate it?

Well, the MVIS Index uses a modified market cap weighting method. That means bigger companies have more influence in the index, but it’s balanced so that no single company dominates completely.

For example:

- If Tencent’s stock rises, the index may go up more strongly because it’s a huge player.

- If a smaller company falls, it has less effect on the overall index.

This way, the index stays realistic while still giving fair representation to multiple companies.

| Component (Company) | Country | Approximate Weight |

| Tencent Holdings Ltd. | Cayman Islands (KY) | 8.15% |

| Nintendo Co Ltd | Japan (JP) | 7.45% |

| Roblox Corp | United States (US) | 7.13% |

| NetEase Inc-ADR | Cayman Islands (KY) | 6.59% |

| Take-Two Interactive Software Inc | United States (US) | 6.30% |

| Electronic Arts Inc | United States (US) | 6.25% |

| GameStop Corp | United States (US) | 4.88% |

| Aristocrat Leisure Ltd | Australia (AU) | 4.85% |

| International Games System Co | Taiwan (TW) | 4.49% |

| Capcom Co Ltd | Japan (JP) | 4.47% |

| (Total of Top 10 Components) | – | ~60.56% |

Benefits for Investors

So, why should an investor care about this index? Here are a few solid reasons:

- Diversification – Reduces the risk of relying on one company.

- Exposure to Growth – The gaming industry is still expanding, especially mobile gaming and esports.

- Transparency – Investors know what’s inside the index.

- Accessibility – Through ETFs (Exchange-Traded Funds) linked to the index, even small investors can join.

A popular example is the [VanEck Video Gaming and eSports ETF (ESPO)]

(https://www.vaneck.com/us/en/investments/video-gaming-and-esports-etf-espo/), which directly tracks this index.

Challenges and Risks

Of course, no investment is risk-free. The gaming industry has its ups and downs.

- Trends Shift Quickly – A game can be hot today and forgotten tomorrow.

- Regulations – Governments sometimes limit gaming hours or impose restrictions, especially in countries like China.

Competition – New companies pop up often and big players must adapt.

- Economic Downturns – Even gaming can slow when global markets struggle.

Future of Gaming & the Index

Looking ahead, the MVIS Global Video Gaming & Esports Index is likely to keep evolving as the industry changes.

- Mobile Gaming Growth – Smartphones are making games more accessible.

- Virtual Reality (VR) & Augmented Reality (AR)– New tech will bring fresh investment opportunities.

- Streaming Platforms – Services like Twitch and YouTube Gaming continue to expand.

- Metaverse– This concept could transform how gaming, social interaction and investment connect.

FAQs

What is the MVIS Global Video Gaming & Esports Index?

It’s a stock market index that tracks the performance of companies earning most of their revenue from gaming and esports.

How can I invest in this index?

You can invest through ETFs such as the [VanEck ESPO ETF]

(https://www.vaneck.com/us/en/investments/video-gaming-and-esports-etf-espo/), which follows the index.

Which companies are included?

Big names like Nintendo, Tencent, Activision Blizzard and Nvidia are usually part of it.

Why is this index important?

It helps investors track the overall growth of the gaming industry instead of just focusing on one company.

Conclusion

The MVIS Global Video Gaming & Esports Index is more than just numbers on a chart. It’s a reflection of how gaming has transformed into one of the most powerful industries in the world. From Nintendo classics to esports tournaments with prize pools in the millions, gaming is shaping culture, entertainment and even the global economy.

For investors, this index offers a way to join the ride without betting on a single company. For fans, it is proof that the games we love are not just fun, they’re part of a massive global movement.

So, whether you’re a gamer, a fan or an investor, keeping an eye on this index is like watching the heartbeat of the gaming industry itself.

Pingback: Advertising FeedBuzzard: Tips, Strategies, and Celebrity Campaigns - LeatHeling

Pingback: Netflix Has Canceled a Popular Series: Full 2025 List of Shows Ending After One Season - LeatHeling